In environments where inflation or rising costs are a factor, FIFO can show higher profits by selling older, less expensive inventory first. FIFO’s ability to impact the bottom line in the short term offers a more attractive financial position to investors and stakeholders. First in, First out inventory method is compliant with IFRS and GAAP, which makes it ideal for companies with global operations form 1040ez definition or aspirations. It also simplifies the process of mergers, acquisitions, or entering new markets. FIFO (First-In, First-Out) aligns with this principle by serving as a critical framework in inventory management and accounting. It plays a crucial role in various industries, from retail to manufacturing, and helps businesses accurately track their stock movement and financial performance.

FIFO in the Food and Beverage Industry

FIFO shows your true gross and net profits in times of increasing inventory prices. It removes the ambiguity of financial reporting because the values used in your cost of sales figures are more accurately represented on your profit and loss statement. Last-in, first-out (LIFO) is a stock valuation method where the last items produced or placed into your inventory stock are the first items you sell. Under the LIFO method, the remaining inventory at the end of your accounting period is your older stock, the inventory that you purchased or produced first. First-in, first-out (FIFO) is a cost-flow inventory method used to value inventory stock. FIFO assumes the items first purchased or first produced are the first items to be sold.

How to Adjust Entries Ending in the Inventory Periodically

Additionally, sectors that rely heavily on just-in-time inventory systems might struggle to implement FIFO effectively. FIFO is the best method to use for accounting for your inventory because it is easy to use and will help your profits look the best if you’re looking to impress investors or potential buyers. It’s also the most widely used method, making the calculations easy to perform with support from automated solutions such as accounting software. Throughout the grand opening month of September, the store sells 80 of these shirts. All 80 of these shirts would have been from the first 100 lot that was purchased under the FIFO method. To calculate your ending inventory you would factor in 20 shirts at the $5 cost and 50 shirts at the $6 price.

Improved forecasting of customer demand

The cost of goods sold may appear artificially low, while the ending inventory value is higher. This can create a mismatch between revenues and expenses, making it challenging to assess true profitability. Investors and analysts must be aware of these nuances when interpreting financial statements prepared using FIFO.

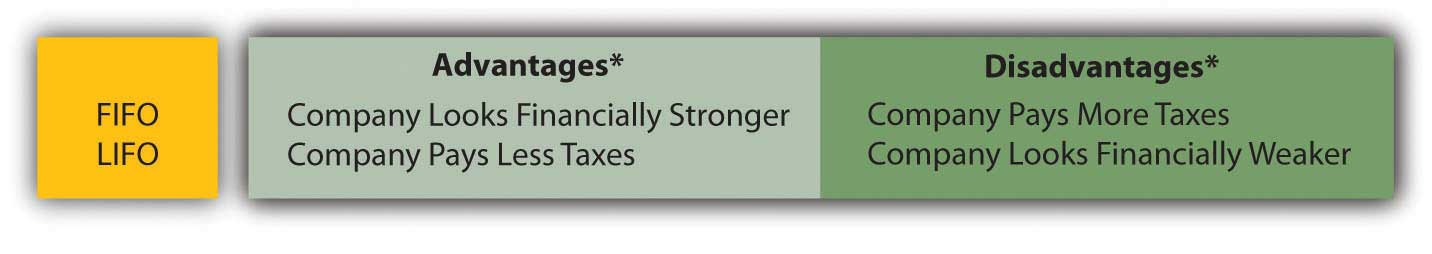

The difference between FIFO and LIFO is that the LIFO method sells or uses the oldest inventory first while the FIFO method sells or uses the newest inventory first. Inventory valuation is conducted much differently using FIFO vs LIFO, so it’s critical you pick the right method for your business. FIFO and LIFO aren’t your only options when it comes to inventory accounting.

- The actual inventory valuation method used doesn’t have to follow the actual flow of inventory through a company but it must be able to support why it selected the inventory valuation method.

- With over a decade of editorial experience, Rob Watts breaks down complex topics for small businesses that want to grow and succeed.

- Continuously refine your processes based on audit findings and stakeholder feedback for more effective FIFO implementation and better overall inventory management practices.

- Inventory is assigned costs as items are prepared for sale and based on the order in which the product was used.

Rohit Rajpal is an accomplished writer with a deep understanding of technology, digital marketing, and customer service. He brings extensive expertise in ERP and CRM systems, blending technical insight with clear, engaging content. Rohit’s work bridges the gap between complex concepts and accessible communication for diverse audiences. The method for calculating the final inventory value remains consistent across different accounting approaches. LIFO is difficult to understand with many investors unable to grasp its complexities and the impact of inflation on the business’s reported earnings.

In normal economic circumstances, inflation means that the cost of goods sold rises over time. Since FIFO records the oldest production costs on goods sold first, it doesn’t reflect the current economic situation, but it avoids large fluctuations in income statements compared to LIFO. The weighted average cost method calculates COGS and ending inventory based on the average cost of all units available for sale during the period. This method smooths out price fluctuations but may not accurately reflect the actual flow of goods. FIFO, on the other hand, can provide a more precise match between the physical movement of inventory and its financial reporting.

Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. Learn more about what types of businesses use FIFO, real-life examples of FIFO, and the relevance of FIFO with frequently asked questions about the FIFO method. Going by the FIFO method, Sal needs to go by the older costs (of acquiring his inventory) first. Statements are more transparent and it’s more difficult to manipulate FIFO-based accounts to embellish the company’s financials. FIFO is required under the International Financial Reporting Standards and it’s also standard in many other jurisdictions.

By evaluating these factors carefully, businesses can determine the most suitable inventory valuation method to optimize their financial performance. It is up to the company to decide, though there are parameters based on the accounting method the company uses. In addition, companies often try to match the physical movement of inventory to the inventory method they use. In contrast to the FIFO inventory valuation method where the oldest products are moved first, LIFO, or Last In, First Out, assumes that the most recently purchased products are sold first. In a rising price environment, this has the opposite effect on net income, where it is reduced compared to the FIFO inventory accounting method. This results in deflated net income costs in inflationary economies and lower ending balances in inventory compared to FIFO.

As any material flow is also simultaneously an information flow, FIFO is also an information flow. While other sequences need additional information on the sequence (i.e., “Which part is next?”), FIFO automatically includes this information. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. With over a decade of editorial experience, Rob Watts breaks down complex topics for small businesses that want to grow and succeed. His work has been featured in outlets such as Keypoint Intelligence, FitSmallBusiness and PCMag.