Your products, country, tax expectations, financial reporting objectives, and industry norms will help you define what inventory accounting method is right for your business. FIFO assumes that the oldest products are sold first, but it’s important to make sure that this practice is actually applied to your warehouse. There are also some best practices to consider when adopting the FIFO method. Conducting regular inventory audits is vital, and involves conducting periodic audits to ensure the accuracy of inventory records. With clear labeling and organization, the identification of older stock is facilitated – which is necessary for the First In, First Out strategy.

How to Adjust Entries Ending in the Inventory Periodically

For example, when inbound pallets of inventory are stacked vertically as they are received, the last pallet (the one on the top) is always the first pallet of inventory to be used. The most important thing is that you select the most efficient method for your specific business type, size, and industry. The FIFO and LIFO methodologies are polar opposites in inventory accounting. Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales.

Pros and Cons of First In First Out (FIFO) Inventory Control

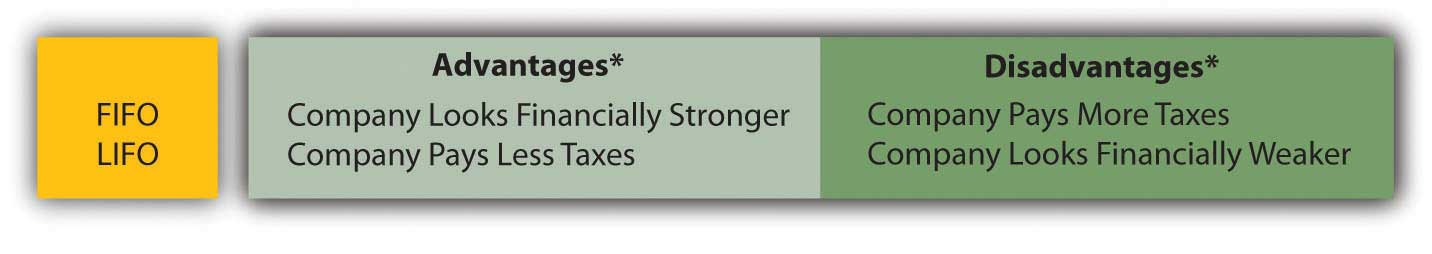

In times of rising prices, FIFO results in higher reported earnings because it pairs current sale prices with inventory purchased at earlier, lower costs. Companies may find themselves paying more in taxes without a corresponding increase in cash flow, potentially straining their financial resources. By assuming older stock is sold first, FIFO ensures the balance sheet reflects more recent purchase prices in inventory valuation. This offers a more precise valuation of current stock levels and enhances the accuracy of financial ratios and forecasts. It also aids in better inventory management by helping businesses make more informed decisions about restocking, pricing, and product lifecycle management.

More complicated than LIFO

In some cases, a business may use FIFO to value its inventory but may not actually move old products first. If these products are perishable, become irrelevant, or otherwise change in value, FIFO may not be an accurate reflection of the ending inventory value that the company actually holds in stock. Along with the best practices, come a series of common mistakes we caution you to avoid. Firstly, ignoring stock rotation can result in older inventory being overlooked.

Adopting a FIFO strategy can help businesses manage stock flow more efficiently and generate accurate financial reporting. Powerful mobile inventory solutions like RFgen can help your enterprise revolutionize inventory management with automation and barcoding, regardless of what inventory valuation method you use. If inflation were nonexistent, then all three of the inventory valuation methods would produce the same exact results. When prices are stable, our bakery example from earlier would be able to produce all of its bread loaves at $1, and LIFO, FIFO, and average cost would give us a cost of $1 per loaf. However, in the real world, prices tend to rise over the long term, which means that the choice of accounting method can affect the inventory valuation and profitability for the period. The First In, First Out (FIFO) method is a widely used inventory valuation technique that plays a crucial role in efficient inventory management.

- Embrace the FIFO method today and transform your inventory management practices to achieve greater success in your operations.

- For example, a company that sells seafood products would not realistically use their newly-acquired inventory first in selling and shipping their products.

- FIFO is a widely used method to account for the cost of inventory in your accounting system.

Grocery Stores: Freshness Before Expiration

It’s also an accurate system for ensuring that inventory value reflects the market value of products. Manufacturers benefit from FIFO by maintaining a consistent flow of raw materials and finished goods. This method helps in managing production schedules and reducing the risk of stockouts or excess inventory. FIFO is particularly useful in industries where materials have a limited shelf life or where production processes rely on a steady supply of inputs. The company’s accounts will better reflect the value of current inventory because the unsold products are also the newest ones.

Consider the following practices to ensure your FIFO calculations are accurate and up to date. Let’s say that a new line comes out and XYZ Clothing buys 100 shirts from this new line to put into inventory in its new store. how big companies won new tax breaks from the trump administration Forge strong relationships with your suppliers to ensure their cooperation in adhering to FIFO principles. Communicate your requirements clearly, establish efficient communication channels, and encourage open dialogue.

Ready to enhance your inventory management and boost your operational efficiency? Discover how Cadre’s Warehouse Management System can streamline your FIFO processes. Not only does FIFO prevent materials from going unused or degrading, it also reduces waste and losses—not to mention storage costs. Optovue, a global manufacturer of ophthalmic imaging equipment, uses mobile software to keep FIFO rules in check while also simplifying traceability compliance. With the assistance of technology, the company operates with near-perfect inventory accuracy.

Entities can easily use FIFO with periodic or perpetual inventory systems. The First In, First Out FIFO method is a standard accounting practice that assumes that assets are sold in the same order they’re bought. All companies are required to use the FIFO method to account for inventory in some jurisdictions but FIFO is a popular standard due to its ease and transparency even where it isn’t mandated. Average cost inventory is another method that assigns the same cost to each item and results in net income and ending inventory balances between FIFO and LIFO.

Essentially, it prioritizes the sale of older inventory before newer stock. This approach is particularly beneficial in industries where products have a limited shelf life, such as food and pharmaceuticals, as it minimizes the risk of spoilage and obsolescence. Seamless integration between inventory management and accounting systems ensures FIFO calculations are correctly reflected in financial reports.

For example, the seafood company, mentioned earlier, would use their oldest inventory first (or first in) in selling and shipping their products. Since the seafood company would never leave older inventory in stock to spoil, FIFO accurately reflects the company’s process of using the oldest inventory first in selling their goods. The average inventory method usually lands between the LIFO and FIFO method. For example, if LIFO results the lowest net income and the FIFO results in the highest net income, the average inventory method will usually end up between the two. Do you routinely analyze your companies, but don’t look at how they account for their inventory?